The banking crisis that has now claimed Credit Suisse has everyone evaluating bank-related risks across ETF portfolios.

It’s a no-brainer that ETFs accessing financials and related segments to varying degrees are faced with risks associated with this crisis. It’s also pretty obvious that exchange-traded notes (ETNs) are in the line of fire as unsecured debt notes issued by financial institutions, aka banks. Credit Suisse itself is estimated to be behind some $700 million in ETNs.

However, one less-obvious place where bank-related risks may lurk is among structured notes used in ETFs, specifically equity-linked notes (ELNs.)

ELNs are a type of structured product that brings together a debt security with an equity options component, designed to offer investors some level of principal preservation, some income generation, and some participation in the returns of the underlying equity. Typically, the payoff of a product like an ELN is either growth or income.

As a structure, ELNs aren’t that widely used within ETF portfolios, but we’ve seen them peppered in some hugely popular funds, like the J.P. Morgan Equity Premium Income ETF (JEPI) and its Nasdaq-linked counterpart, the J.P Morgan Nasdaq Equity Premium ETF (JEPQ).

These ETFs, which invest in large cap equities and sell S&P 500 or Nasdaq 100 call options (respectively), wrap the options in ELNs in an effort to capture options premium as dividend income. (We recently looked into how JEPI works here.)

In the context of a banking crisis, it’s important to remember that ELNs are debt notes issued by banks, which means ETFs that use ELNs face credit risk associated with the banks issuing these notes.

Is it a meaningful risk?

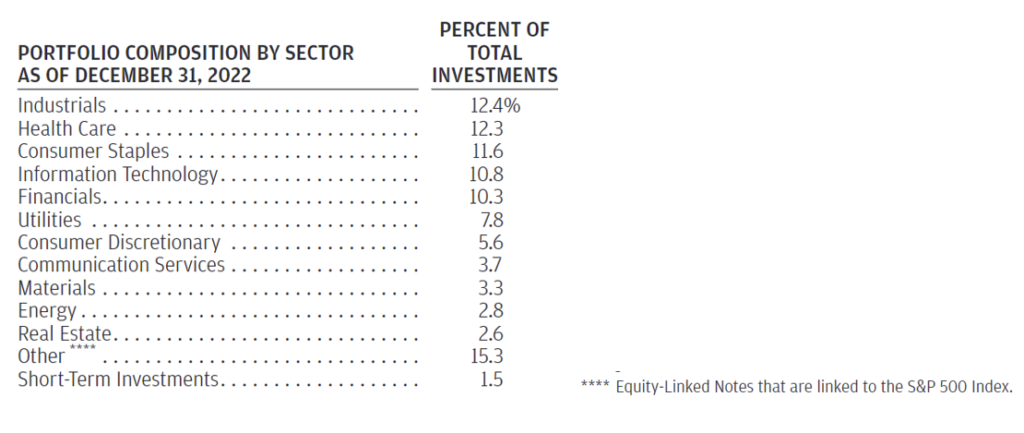

In truth, it depends. In the case of JEPI, for example, the $21.5 billion Fund showed in its last semi-annual report (as of Dec. 31, 2022) that it had a 15.3% allocation to ELNs. (Image below). For context, that position is below the Fund’s cap, as detailed in its prospectus, where ELNs are limited to no more than 20% of the portfolio at any time.

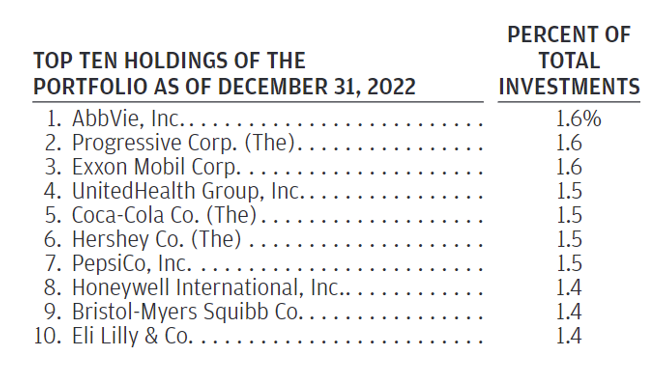

A closer look at the top 10 holdings in JEPI as of Dec. 31, 2022, shows that a bank such as Credit Suisse is notably absent from the mix, according to the report. In fact, there are no ELNs among top holdings:

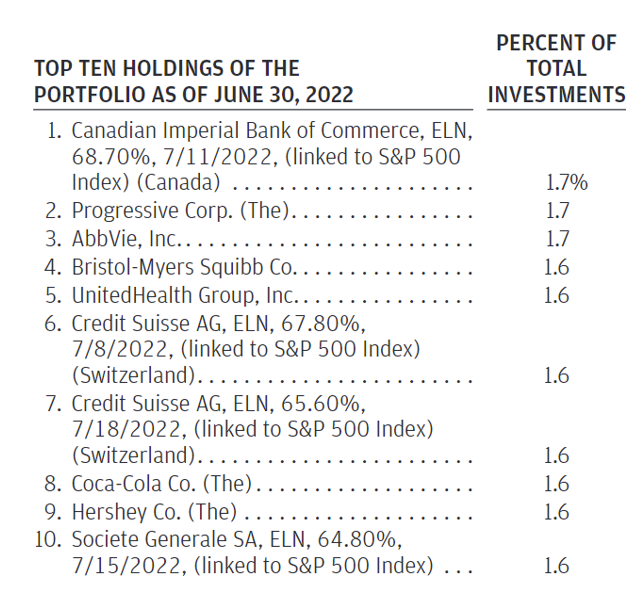

But that’s not always the case. Just six months earlier in the previous annual report dated June 30, 2022, Credit Suisse ELNs were among top positions totaling 3.2% of the fund’s portfolio, along with notes from Canadian Imperial Bank of Commerce as well as Societe Generale. (Image below)

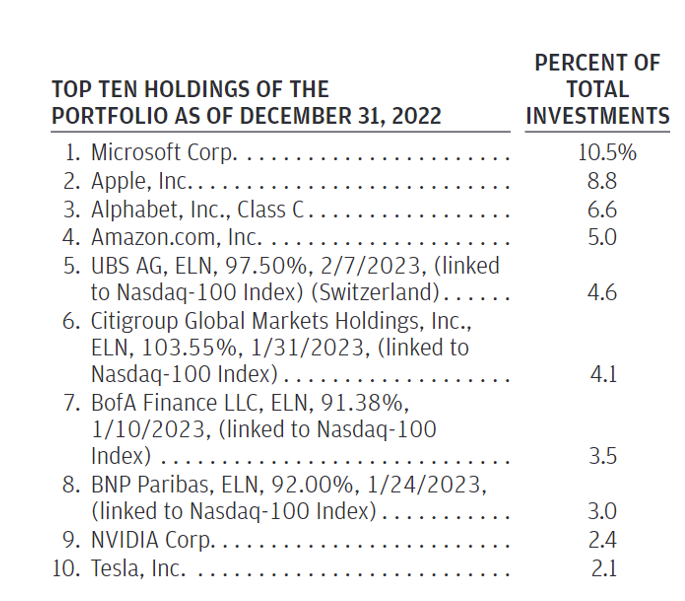

JEPI’s Nasdaq counterpart, JEPQ, tells a similar story. JEPQ, which has about $2 billion in assets, had ELNs representing about 17.3% of the portfolio mix as of Dec. 31, 2022, according to the semi-annual report, but no Credit Suisse ELNs to be found in the top bracket. UBS, however, sat there with a 4.6% position, followed by Citigroup, Bank of America and BNP Paribas. (Image below)

Structured notes are big business to banks, which take into account many factors such as balance sheet and market conditions when pricing and issuing these products, but the changing mix of issuers across JEPI and JEPQ tells us that fund managers aren’t limited to a single bank for its ELNs. They have a choice and that choice can change at any time.

So, Should You Worry About ELNs?

Broadly speaking, if you invest in an ETF that includes ELNs, you are exposed to credit risk associated with the bank issuing those debt notes. However, there are other things to consider.

First, your exposure is limited by regulatory design. The Securities and Exchange Commission Rule 12d3-1 of the Investment Act of 1940 caps single issuer risk to 5% of ETF portfolios, which in the case of exposure to an issuing bank behind ELNs means that position – exposure to that bank – can’t exceed 5%. And remember that in the case of JEPI and JEPQ, the fund’s prospectuses further cap ELN weightings at 20%.

Second, position size matters, but so does term. How long until the ELNs in the portfolio hit maturity? You could argue that in the case of a market event such as a banking crisis, the shorter-term the ELN is the more easily it can be unwound early or allowed to simply expire without much effect vs. a longer-term position – say one year to maturity or longer. Do you know the average term of an ELN in your ETF?

Third, there’s the issue of liquidity of the underlying. If you take JEPI as an example, the S&P 500 options market is a deep $1 Trillion market, with ample liquidity, making transacting across the ELNs easy to do in the secondary market. Consider that through Friday, March 17, as news of Credit Suisse’s troubles swirled and concerns about a banking crisis deepened, JEPI’s 30-day median bid/ask spread remained at a tight 0.02%, data shows.

And finally, you could argue a banking crisis is a prime opportunity to get to know your ETF’s investment approach. If your fund is run by an active manager, do you know the rules they follow and their expertise in the space? It’s in times like these that experience with everything from security/partner due diligence to position management to portfolio structuring and trading that can make a big difference in overall results. As you fret about a global banking crisis, do you actually know your active manager, or how your ETF is managed day to day?

ELNs or no ELNs, it’s always a good time to know what you own.

Disclosure

All investments involve risk, including possible loss of principal.

This material is provided for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).