This past year may go down as one of the most challenging market years in recent memory, but for the ETF industry it was yet another year of interesting product innovation and asset creation.

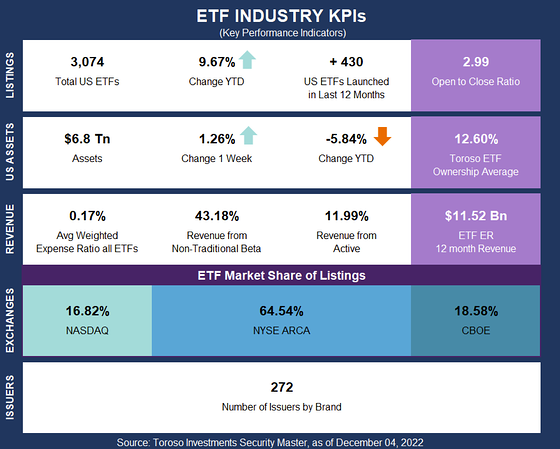

Our weekly tracking of the ETF industry (in the KPIs below) has shown throughout this year that new ideas keep on coming to market, disrupting the old, enhancing the existing, and breaking new ground week after week to the benefit of investor outcomes.

We are closing 2022 with more than 430 new ETFs in the market and hundreds more currently awaiting in the regulatory pipeline. We’ve also seen 30-plus mutual funds convert to ETFs (some completing early next year), bringing some $60 billion in assets to the ETF market.

All of this activity has been led by veteran and new ETF issuers alike – we are ending the year with 272 product providers in the marketplace, or 26 more ETF issuers in the market than we had a year ago.

The ETF industry remains predominantly passive in terms of assets, full of traditional beta products that are this industry’s origin story, but there’s been a lot of growth and innovation in the non-traditional passive, style and factor, active and enhanced-type ETFs that are getting sharper and more focused in the market access they seek to provide.

Consider some of the most interesting product innovation we’ve seen this past year:

Inflation, deflation and stagflation fighter ETFs – The past year was not a big year for thematic investing, except perhaps for inflation – the biggest theme of 2022. The ETF industry did not disappoint. In true ingenious and nimble form, it quickly delivered new solutions that targeted a pressing theme. Thanks to product innovation, there’s now ETFs for that.

Options-based and options-enhanced ETFs across market segments – Options are no longer the instrument of the few. Thanks to ETFs, it’s now within reach of the many. The use of derivatives in ETFs took off in 2022 thanks to friendlier regulation, peppering across various ETFs for various purposes, driving or enhancing returns as needed. Appetite for options across market segments (and trading volumes) was one of the big stories of 2022, and ETF investors were a part of that.

Sentiment-based, values-based, faith-based and anti-all-that ETFs – This is an interesting space where democratization meets personalization. Whether it’s tied to the environmental/social/governance (ESG) investing trend or as standalone ideas focused on narrower themes and views, ETFs continue to find ways to deliver narrowly specific access but to everyone. It’s quite the achievement.

Pundit ETFs – From Jim Cramer to Congressional members to Youtube personalities, these ETFs coming to market offer access to the way these folks see the world and try to invest accordingly (or against it). In some ways, pundit ETFs (or influencer-linked ETFs) are a new take on the Bring-Your-Own-Assets (BYOA) trend that characterized the early success of big asset and investment managers in the ETF space a few years back. But instead of BYOA, these influencer-type funds are BYOF – Bring Your Own Following – with the hope that fans translate into assets. It’s early days, but it has already been an interesting space to watch as Wall Street meets Fintwit.

Single stock ETFs – Perhaps one of the most surprising debuts this year was the single stock ETFs, which come in two basic flavors: leveraged and inverse at varying degrees. Defying the industry’s hallmark call for diversification, these funds go all in on a single name. As a segment, this space has already grown to include single ticker ETFs that package an existing ETF with an options overlay for income generation where none existed before. This is a wild new frontier of product development.

Single bond ETFs and sector-specific high yield credit ETFs – Fixed income, too, welcomed some new laser-focused tools that offer investors bond-specific or sector specific access to fixed income. These ETFs allow investors to be tactical on their yield curve/duration exposure like never before, as well as on the sector risk they take tied to their search for high yield.

The ETF Think Tank

These are just some of the highlights of what has been a busy year in the ETF industry. There’s been much to celebrate. We know that not every new ETF is for everyone, and that not every new ETF will survive, but we also know that many will dramatically improve investor outcomes in all sorts of market environments.

As we look back on this year, we also wanted to take a quick moment to say thank you for counting on the ETF Think Tank team for research, insight, due diligence help, and ETF ideas. We’re constantly learning, and constantly growing side by side with you all. Thank you!

Happy Holidays!

Disclosure

All investments involve risk, including possible loss of principal.

This material is provided for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).