Launching an ETF is great, but having a successful ETF is what it’s all about.

We recently explored the many reasons why you may want to consider launching an ETF. From operational benefits to your business to product lineup completion to tax advantages and broader reach – the virtues of the ETF wrapper are many to both investor and product provider.

But launching an ETF, in many ways, is the easy part. Keeping an ETF alive and thriving is where the rubber meets the road.

The success of an ETF, as defined by asset growth and longevity in the marketplace, hinges on what we at the ETF Think Tank call necessary conditions:

- The product has to be right.

- The capital support needs to be there.

- The infrastructure must be in place.

Meeting these conditions in no way guarantees success, but they improve the odds of having your ETF rise above a noisy, crowded marketplace and find a following that proves to be sticky overtime.

ETF Graveyard

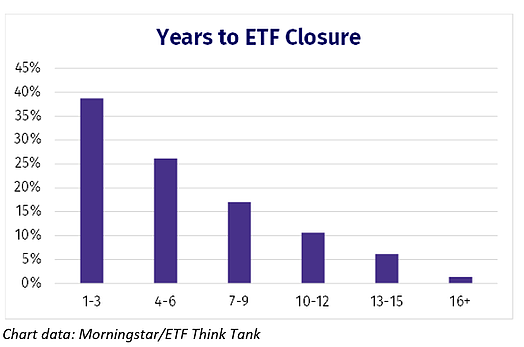

The first couple of years are the most challenging for any ETF because without a lot of assets and without an established live track record, many ETFs struggle to find their way into the advisory channel where the bulk of investable assets sit.

Data shows that most ETFs that end up closing, do so within the first two years. Getting an ETF to survive that initial phase is the first step toward success.

Necessary Conditions for ETF Success

- The product has to be right.

An ETF has to solve an investor problem. Innovation can come in the form of new market access, better access to an existing asset class or segment, and/or lower fees. But innovation must be there if an ETF is to have a real chance of success.

In the early days of this industry, there was a lot of white space for ETF exploration. Today, the low-cost traditional beta segment is all but tapped out, smart beta and thematic ETFs have grown dramatically in number, and strategies and niches have been sliced and diced in ever narrower slices. Coming up with a novel idea that breaks new ground is no small task. But it can be done, and it is being done by old- and new-to-market issuers every day. Just in the past year, the industry has welcomed 50 new ETF issuers and more than 400 new products.

There are many ways in which a product can be right.

One of the avenues to success is to start off with an existing – successful – strategy living as an SMA, mutual fund, hedge fund or newsletter, and convert that strategy to an ETF. The benefits of the ETF wrapper relative to other investment vehicles – transparency, liquidity/intraday tradability, low cost and tax efficiency – offer what we call structural alpha to the end investor. That is one way in which an ETF solves an investor problem.

Another way is to offer either impressive performance or competitive pricing.

The first, performance, is harder to control because markets are impossible to predict. But if you bring to market a product that delivers strong performance – whether that’s by closely tracking an index or outperforming a benchmark – chances are assets will follow. Asset flows combined with market gains translate into asset growth. And assets point to longevity.

The second, price, is an easier equation to solve. The guideposts of what works are already in place.

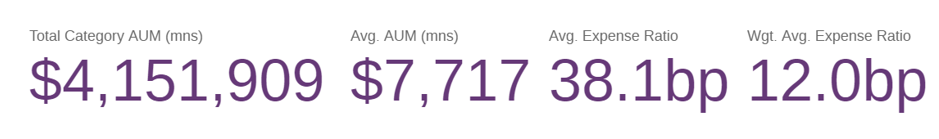

In the purely beta space, the price bar is set extremely low. According to our data, the weighted average expense ratio among traditional beta ETFs (where $4.1 trillion in assets sit as of Nov. 30) is 12 basis points – or $12 per $10,000 invested. For large cap US equity traditional beta funds, that average fee is only 10 bps.

- Outside the traditional beta space, the price bar sits a little higher. In truth, the higher the active share a fund has relative to a benchmark, the more it’s able to charge without a lot of friction. Consider that the weighted average expense ratio among fully active funds currently sits at 42.6 bps – that’s 3.5x the rate of traditional beta funds.

For complex strategies that tap into leverage and derivatives, as well as most alternative asset classes, the tolerance for fees is even higher because these strategies are often benchmarked against other investment products such as mutual funds and hedge funds. The average leverage ETF today charges 98 bps, and the segment has a weighted average expense ratio of 87.7 bps.

There’s no question that the ETF industry is not exactly known for being a revenue generating powerhouse. Our latest ETF KPIs data show that ETF revenues from fees sit around $12 billion a year. - The capital support needs to be there.

It takes money to launch an ETF, and it takes money to keep an ETF running. In some ways success starts with survival, so a provider needs to be able to support the operations of a fund until it finds critical mass.

Estimates vary depending on the type of strategy and services needed, but a good rule of thumb is that it can cost anywhere from $50,000 to $70,000 to launch an ETF, and an estimated $200,000 to $250,000 a year to keep that fund running.

In the absence of any asset growth in the fund, these operating costs would have to be out of pocket for the ETF provider, so securing capital is important.

Part of that capital need is the initial seed. The size of the ETF seed at launch – or very early on – is not in itself a necessary condition, but it’s a game changer in the race to survival.

Yes, an ETF can come to market with $1 million-$2 million in seed capital, but most advisors and many investors will not even look at an ETF until the fund has at least $10 million in assets, and in many cases, $25 million minimum. The bigger the seed, the better the chances a new ETF finds traction right out of the gate, and kick starts that asset growth journey.

Operating costs and seed are critical to an ETF surviving and thriving, which makes capital support a key component of any ETF’s success story. - The infrastructure must be in place

There are a lot of moving parts to running an ETF. The basic operational infrastructure any ETF needs includes:

- A trust and a board of directors

- A legal/compliance team that tackles regulatory paperwork and ensures activities related to the management and marketing of an ETF comply with the latest regulations

- A trading desk/team that manages day-to-day share trading and creation/redemptions, interacting with authorized participants and market makers

- A distribution team (the right face for the fund) that tackles marketing and sales of the ETF

Some ETF providers have these resources inhouse, especially larger companies. Many smaller and up-and-coming ETF issuers access this infrastructure through various partnerships and service agreements across the industry.

The good news is that a lot of these needed services can be outsourced, but it’s important to remember that the success of an ETF long-term requires excellence in every part of this ETF ecosystem, from day-to-day operations to trading to marketing and distribution.

Game Changers

Success in the ETF market is never guaranteed, however there are a few actions that can have a massive impact when combined with the necessary conditions.

Seed capital, as mentioned above (Also, read: https://blog.etfthinktank.com/blog/2021-was-great-for-etfs) is one of them. If you can innovate in access and/or fees and do it with a strong seed to start, chances of success are good.

Other possible game changers include:

- Thoughtful mutual fund conversions (as mentioned above)

- Partnerships with influencers or a strong distribution network

- Servicing an existing captive asset base – bring your own assets

Beyond that, there are two other small, less obvious things to consider. First, it’s the value of a clever ticker. The ETF market speaks in tickers, making them the calling card to the strategy itself. (Read: https://blog.etfthinktank.com/blog/etf-ticker-premium)

Is a ticker a game changer? Hardly. But a clever, memorable ticker can help an ETF stand out and tell its story effectively. As an example, consider these tickers: JETS, EATZ, BEDZ, CIBR, BOTZ, MEME, FOMO. They are clever, they are catchy, and they are descriptive – the trifecta of a good ticker. Being memorable always beats being forgettable.

The second thing is luck. Sometimes success comes from being at the right place at the right time, like launching a product in the perfect market environment for it, or being first to market with a strategy on the eve of a new trend that takes off like wildfire. The opposite is also true: it can happen that an ETF is a great idea but ahead of its time, or too late to the game.

Luck is completely outside of anyone’s control, even if it can help secure an ETF’s chances of success. The best anyone can do here is hope that luck is on your side.

Obviously, lining up all of these necessary conditions and game changers perfectly isn’t easy. If it were, everyone would build an ETF. But it can be done, and with a little bit of luck, success will most likely follow.

(Learn more: Why launch an ETF, How to build an ETF, Tidal ETF services)

Disclosure

All investments involve risk, including possible loss of principal.

This material is provided for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).

Topics: Weekly Research