Will Elon Musk close the $44 billion Twitter deal before Halloween? It is scheduled to close by Friday, October 28th. How many folks are planning to dress up as Elon Musk, or even a new Tesla, for Halloween? Oh, so much drama, and for what? Elon says he is excited about closing the deal, despite arguably overpaying, possibly needing to sell billions more of Tesla stock, and rumors of massive layoffs at the firm. Many of the banks involved plan to retain $13 billion of the bank loan that Elon needs to fund the deal, probably through at least the end of 2022. This is arguably due to tight supply of this fixed income cap structure, and it can be lined up well with other areas of a large institution’s liability structure.

Senior Loans: Active vs Passive

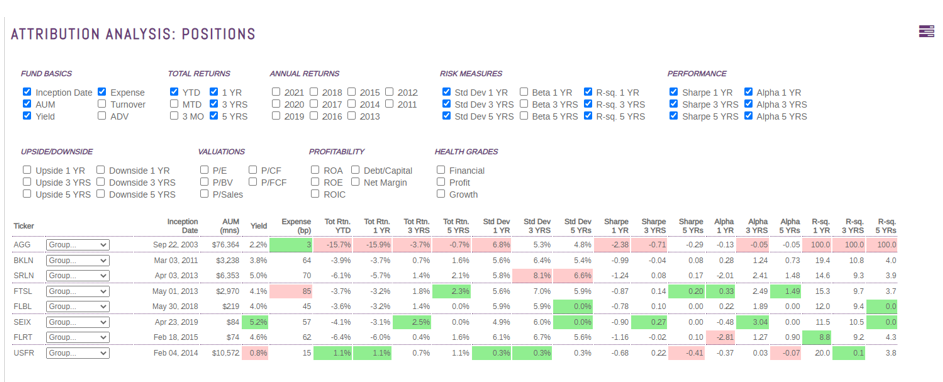

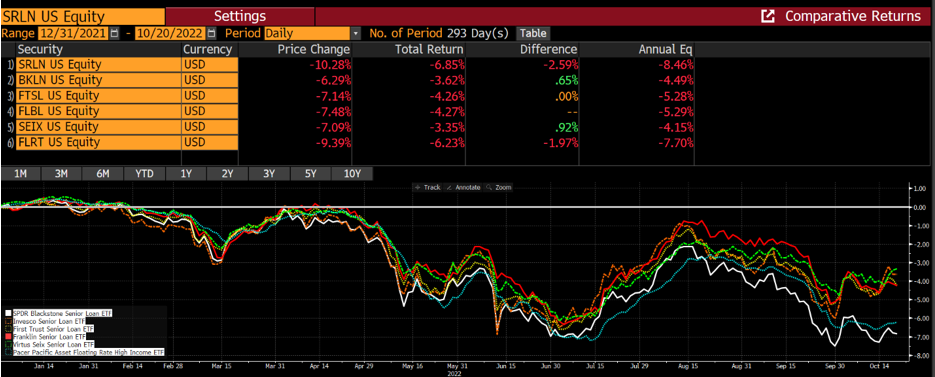

All this brings us back to this question: What is happening in the bank loan market? There are 6 bank loan ETFs, 4 of which are actively managed. AUM for the category totals $13.458 billion, with an average fee of 62.5 BPS. On a long-term basis, it would seem logical to believe that active would outperform in this space due to the ability to source liquidity in the primary and secondary market on a timely basis, rather than simply on a systematic basis. A key difference between most of these funds is the number of holdings. There are 533 holdings in SPDR Blackstone Fund (SRLN), versus 133 holdings in the Invesco Senior Loan fund (BKLN). This could mean that Twitter bonds could end up in one of the active funds as a “Trick or Treat!” Beyond SRLN and BKLN, the First Trust Senior Loan Fund (FTSL) is active and has a solid third place position with $3 billion AUM and 199 holdings. We exclude two newer funds in the first chart (Virtus SEIX Loan ETF (SEIX) and Pacer Pacific Floating Rate High Income ETF (FLRT)) to illustrate how the group has performed on a long-term basis. We also include a helpful interview with Gordon McKemie, Portfolio Manager of the SPDR Blackstone Fund, that is displayed on the ETF Think Tank YouTube Channel with some further information from the ETF Think Tank Tool.

How to Monitor this Fixed Income Category

We think this area of the fixed income market needs to be monitored closely given its role on M&A, bank balance sheets, and its correlation to high yield. It is also important to highlight that this category is known to be correlated with inflation, even though inflation has been absent for so many years. Hence, there may be no surprise that in its latest monthly dividend, SRLN raised its dividend payment sequentially by about 10% to $0.22 from $0.20. This space, nevertheless, is not without challenges. while many of the banks reported low exposure to the category in this third quarter, Citigroup reported a $110 million markdown which, overall, was better than the write down of about $1 billion across the banking sector in the previous second quarter. We hope to learn more about the overall health of this category during our ETF Think Tank Happy Hour on November 3rd with Lee Shaiman. Currently, Lee is the Executive Director of the Loan Syndication and Trading Association (LSTA), but he was previously the lead Portfolio Manager of SRLN when it originally was launched. The LSTA is a leading industry resource of information about syndicated lending. Given Lee’s experience, we hope to gain a great deal of constructive insights relating to market liquidity, deal spreads, and how the Twitter deal worked out.

Disclosure

All investments involve risk, including possible loss of principal.

This material is provided for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).