We’ve all heard that if you want access to something – anything – there’s probably an ETF for that. The go-anywhere nature of the exchange-traded fund also means that there’s a growing number of anti-that ETFs.

These funds can be great headline makers, for obvious reasons. What’s not to like about a contrarian attitude to a mainstream theme, or a flash of rebellious flair in the face of some widely accepted investment idea? It’s fun to watch a new fund try to disrupt or challenge the narrative of a well-established existing one – it makes for great storytelling.

But, like anything else packaged in an ETF wrapper, these funds aren’t just about a good story. They are actually about sharpening the tools of the trade, looking for new ways to access markets based on principles, values, themes, all in search of better risk-adjusted returns.

Whether intended as core replacements or as addition/complements/satellite positions to a core allocation, there are some interesting flavors of anti-something ETF investing.

Consider three ETF examples:

- AXS Short Innovation Daily ETF (SARK) – When anti-something means simply taking the inverse view.

The original anti-something ETF, in its simplest form, is any simple short or inverse fund.

SARK is hardly the first inverse ETF. The fund launched in 2021. But it epitomizes this “anti-something” category because it didn’t just come to market to provide investors with a -1x to disruptive growth names. SARK was about taking on Cathie Wood and her die-hard followers with a strategy that bet against ARKK – one of the most talked about funds in ETF land.

If nothing else, this was a stroke of marketing genius. And as luck would have it (the issuer would probably say it was pure brilliance), the fund came to market at the perfect time when growth stocks gave way to value names in what has been a devastating year for tech innovation and ARKK itself.

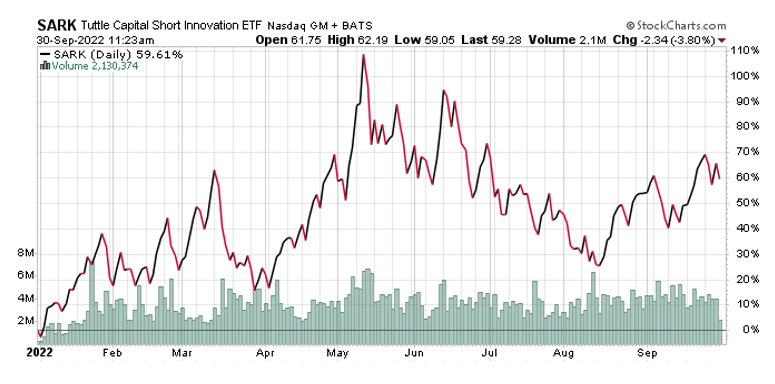

Look at SARK vs. ARKK performance so far in 2022:

SARK year-to-date performance…

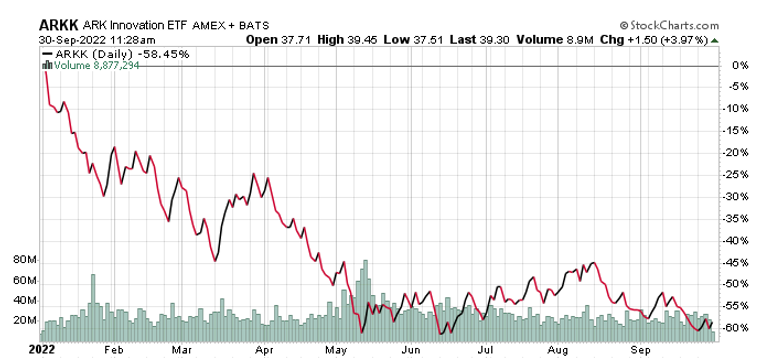

Versus ARKK YTD performance:

Versus ARKK YTD performance:

In this face-to-face, given the inverse design, only one ETF will be a winner at any given time. SARK and ARKK will forever be separated by a mirror.

Cathie Wood herself has been quoted many times as saying that disruptive innovation (ARKK) is a long-term theme, and that standing against it is standing against the power of innovation itself. You may agree or disagree with that. But the point is that no strategy only goes up forever, and when it doesn’t, there’s a clean one-for-one anti-that strategy that can be a tactical tool to capitalize on near-term opportunities.

Just remember that inverse funds – as a general rule of thumb – can quickly fall prey to the power of daily resets and compounding. Watch out your holding period.

- Freedom 100 Emerging Market ETF (FRDM) – When anti-something means excluding offenders found in traditional benchmarks.

In some ways, FRDM has been known as the anti-China emerging market ETF.

When it first came to market some three years ago, it made a big splash with its exclusion of China in a market segment where Chinese stocks typically represent at least a third of passive market-like baskets. Look at the leaders in broad EM investing: EEM, IEMG, VWO, SCHE, etc. They are all big time investors in Chinese stocks.

In truth, FRDM can also exclude any other key emerging market staple like Brazil, for instance, based on its process. The fund challenges the old BRIC view of emerging market exposure, as well as the prevailing take on passive emerging market investing with an anti-authoritarian-governments strategy.

Since its inception three years ago, the anti-China angle has made for great headlines around FRDM, but this ETF is really about freedom as a factor that could drive better risk-adjusted returns overtime.

The investment case behind this strategy is that countries with non-democratic governments, or governments that are too heavy handed in regulation, taxation – all the “ations” that limit innovation and economic growth – are likely to underperform or lag free emerging economies.

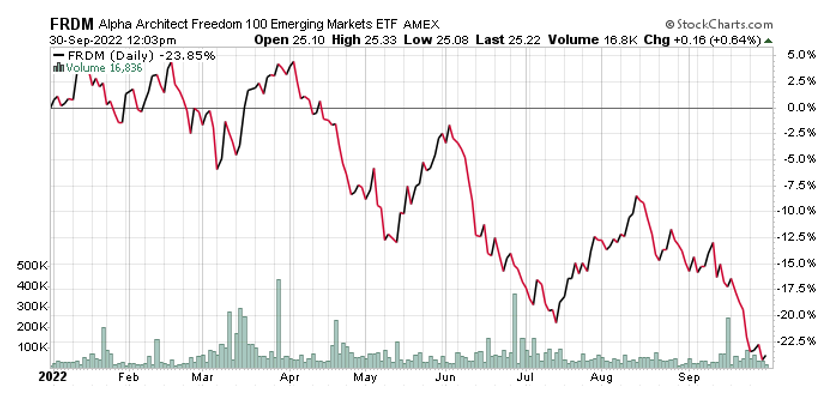

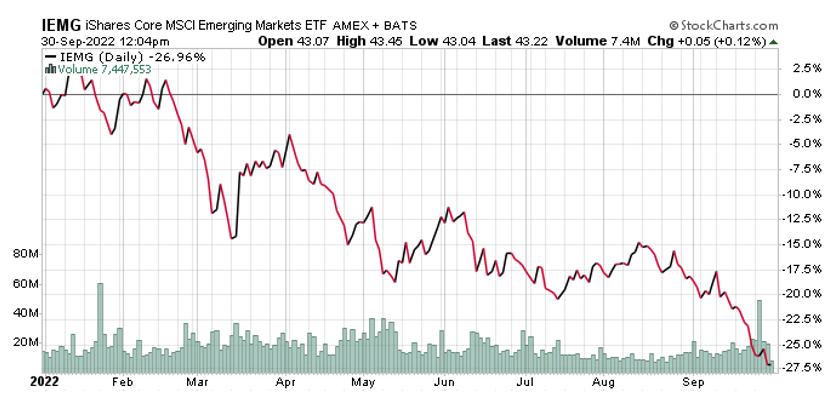

So far this year, the fund has held up a little bit better than a traditional broad EM basked like IEMG, as seen below. The fund is also outperforming IEMG in a three-year time period.

FRDM year-to-date performance…

Versus IEMG YTD Performance:

You may or may not believe in the wisdom (or folly) of excluding some of the biggest emerging economies from an emerging market allocation.

But thanks to the ETF wrapper, you can, and easily too. FRDM is a pioneer in this theme, and it has inspired others like global ex-US DMCY, which isn’t exclusionary, but reweights a global stock portfolio based on democracy metrics, tilting away from authoritarian regimes. There are also similar takes sitting in the regulatory pipeline.

- Constrained Capital ESG Orphans ETF (ORFN) – When anti-something means including the excluded by popular benchmarks.

It’s not clear whether ORFN wanted to bill itself as anti-ESG ETF, but that’s the narrative that has stuck with it because this fund invests only in industries and companies that other broad-based ESG funds exclude – tobacco, alcohol, gaming/gambling, fossil fuels, weapons, and nuclear energy.

For practical purposes, this is an anti-ESG fund. But looking deeper, this strategy is built around what we call a “business characteristic,” which in this case is capital constraint. The investment case here is that the exclusion of these industries by several ESG funds leads to capital constraints for companies in these segments, and that ultimately leads to mispricing of these stocks. That mispricing or distortion is where the opportunity for outsized gains sits.

ORFN launched in May, so it has yet to build a live track record of significance, but launch-to-date, ORFN’s performance looks like this…

Versus ESGU’s performance over the same time period (ESGU is the largest ESG ETF excluding various of the segments ORFN accesses):

A Complete ETF Tool Set

These three ETFs are just a sampling of funds that look to offer access to something other than what’s already out there or the so-called prevailing view of mainstream benchmarks and ETFs. They can get caught up in the hype that contrarian-types tend to elicit, but they are innovative ways to slice and dice markets.

From principles, to ESG, to politics, to popular themes, innovation in this space is booming. From where we sit, that’s the beauty of ETFs living up to their reputation as the ultimate democratizer of market access. Whatever you believe, there’s an ETF for that. Isn’t that grand?

(Charts courtesy of StockCharts.com.)

Before investing you should carefully consider the Fund’s investment objectives, risks, charges and expenses. This and other information is in the prospectus. A prospectus may be obtained by calling 800-794-1485 or visiting constrainedcapital.orfn.com. Please read the prospectus carefully before you invest.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Performance current to the most recent month-end can be obtained by calling (800) 794-1485.

An investment in the Fund is subject to risk including the possible loss of principal. The Fund is new with a limited operating history to evaluate. ETF shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is non-diversified and may be concentrated in certain industries or sectors to the extent the Index is concentrated. In adverse events, the value of fund shares may rise and fall more than if invested in a broader range of industries. The Fund and the Index may differ from each other (known as tracking error) due to fund operating expenses and portfolio transaction costs not incurred by the Index. In addition, the Fund may not be fully invested in the securities of the Index at all times or may hold securities not included in the Index.

ESG investing is defined as utilizing environmental, social, and governance (ESG) criteria as a set of standards for a company’s operations that socially conscious investors use to screen potential investments.

References to other securities is not an offer to buy or sell.

The fund is distributed by Foreside Fund Services.

Disclosure

All investments involve risk, including possible loss of principal.

This material is provided for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).