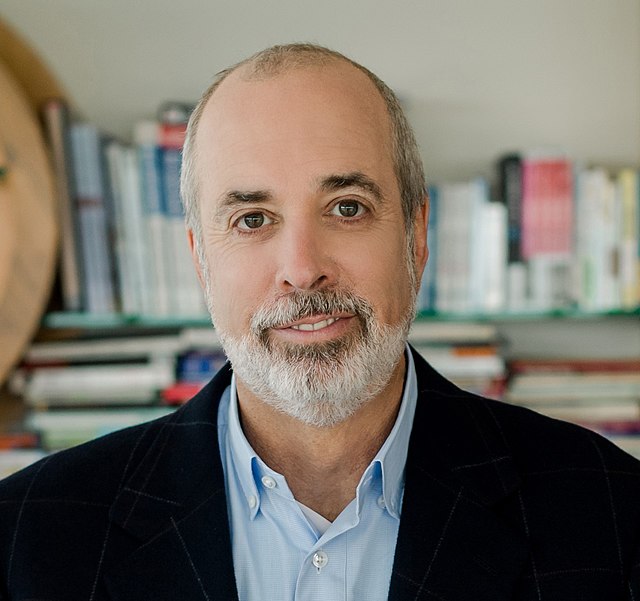

Ric Edelman is one of the country’s most acclaimed financial advisors and industry personalities. Today, he’s focused on digital assets, cryptocurrency and blockchain. He’s a big believer that these exponential technologies will transform the global economy over the next several decades. He joins the ETF Think Tank to discuss this and his viewpoints on the markets.

What was the moment that caused Edelman to pivot over to digital assets? He was attending a program back in 2012 and Bitcoin was one of the topics. Even though it was very early in crypto, he understood that if he dismissed Bitcoin out of hand, it probably meant that he did not understand it. As he studied it, he concluded that it could be a profound technology, maybe even as big as the internet. He says we have to recognize that our world is changing due to exponential technologies. Now, he tries to help bring attention to something that many may ignore.

Edelman says it is not the industries that will be impacted the most, it will be the people. Our current system works pretty well – we move money seamlessly, we get interest on deposits, we’ve got Venmo. The problem is that this only applies to first-worlders. There’s a billion people that don’t have access to this, including those in abject poverty and the unbanked. Blockchain and crypto allows people to participate in a financial system. The bottom billion can become the rising billion.

What are the hurdles to advisors adopting crypto for their clients? For many, it’s not worth the headache. There’s a big education aspect to it. There are compliance issues. Many advisors are doing just fine as it is and don’t have the motivation to change anything. On top of this, digital exchanges don’t want to work with advisors. If advisors cannot logistically do it even if they wanted to and the exchanges put up hurdles to get advisors involved, it is not surprising advisors don’t want to bother with it.

On the flip side, advisors won’t be able to inhibit the changes that are happening, and they run the risk of being left behind. Blockchain development is happening, and technological disruption often destroys companies, but Edelman says he doesn’t really care. Every major central bank is developing blockchain because there are too many advantages. They realize the more familiar they get with it, the more they can leverage it. We could have a massive disruption in the jobs market and that is the biggest risk right now.

Edelman says that the healthcare sector is the one area of the economy waiting to be disrupted by blockchain. Our personal health records, for example, are our best data. Why are they housed at the doctor’s office? Why do specialists have their own sets of records with no interconnectedness? Why don’t consumers have easy access? Blockchain can solve this because how we are currently handling our health records is insane.

Other key takeaways:

- For advisors, managing money is easy. Managing the client is hard. They will argue that they are passive investors but invest in active products. They will say they are long-term investors, but the average holding period is just 6 months. The job of financial advisors should be to get clients to stick with their approach. Edelman would be overweight to exponential technology because you need to invest for the century you are living in.

- Edelman is a big fan of crypto in his portfolio but acknowledges that he is far more overweight than most should be. For most individuals, the crypto allocation should be around 1-5%. This can measurably improve returns without an undue level of additional risk.

- The development and acceptance of blockchain will be a very long haul. Right now, the laws governing this do not exist. What happens if two parties enter into a smart contract transaction and one sues the other one, but they live in different countries? Who has jurisdiction and is it based on residency, wallet location or something else? There needs to be global coordination.

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).