In the ETF Think Tank, we do not avoid awkward conversations. Sometimes important decisions are made when people are uncomfortable. In that regard, this week we decided to take on the discussion of US / China tensions. Our goal is not to get political or point the finger, but rather to highlight the opportunity and hope that people will not fall prey to the media headline hype. US investors need to focus on the opportunity because isolationism and protectionism will not ultimately lead to global growth, and therefore are not realistic options. Moreover, the momentum for China’s envisioned economic growth over the next 10 years is simply too powerful a force to ignore. It is for this reason we have invited hedge fund manager Kyle Bass, as our guest in this week’s 6:00 pm Get Think Tanked Happy Hour (Link to join). Note, Mr. Bass is very vocal and open about his controversial views on the subject of China, and these views do not reflect those of the Toroso Portfolio Managers or the firm. See Kyle Bass on Twitter for details.

US Investors can target China allocations through about 50 different ETFs with almost $19 billion in AUM, and these choices narrow further to 42 ETFs when you eliminate leverage and inverse. Choices exist for China A-Shares, Broad China stocks, the China Bond market, various industry/sectors in China, even solutions that position investors’ alignment with ESG, and companies seeking to have a positive effect on the environment that are based in China. Ironically, the disparity of investment performance between an ETF that focuses on Environment (the KraneShares MSCI China Environment ETF (KRGN) versus a traditional Chinese energy company (the Global X MSCI China Energy ETF (CHIE), shows that YTD performance is positive 55% and down 25%, respectively. (A complete list can be provided upon request, but clear leadership exists in terms of innovation; access of platform choices can be found at KraneShares, DWS and Global X.)

TikTok: The Polls Highlight a Need for Change

Polls show an increased level of anxiety on both sides of the globe. The latest PEW Research poll, from July, found 73% of American respondents have negative attitudes towards China. Similarly, polls show Chinese people also digging in further in support of their political system and lifestyle. The fact is that both countries are at an important crossroads, and polls are suggesting an increased polarization of views in this mid-COVID-19 world which cannot be beneficial for global economic growth. China is the fastest growing economy, and the US is the largest economy. If politicians take us down the route of isolationism, everyone loses globally. While there may be good reason for distrust between both constituencies, the fact is that there is a mutual need for cooperation. This is why the battle over TikTok and the ban of WeChat could become an example of either important compromise or legal precedent. It is for this reason that circumstances need to be discussed openly.

Growth in China

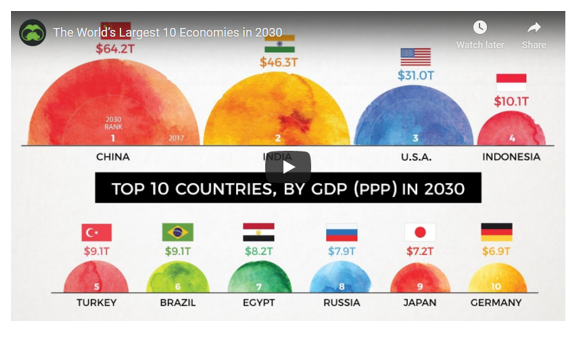

Will China (and separately, India) become larger economies than the US? This is a question that makes many people in the U.S. uncomfortable, and the imagery makes some people even feel powerless. To be clear, linear projected growth should be viewed for illustration purposes only, and the quality of life for most Americans should be emphasized over specific projections. Technology and E-Commerce, of course, is at the core of expected growth, and clearly the lever on both political sides. In addition, questions and risks around a $52 Trillion real estate bubble have also popped up, which could impact global growth and China’s ability to hold 20% of its US Treasuries holdings. According to ZeroHedge, ownership of US Treasuries peaked in 2013 and bottomed in 2016. Exactly what this means is unknown, but let’s not be so hasty in regards to views towards our creditors. Life is a balancing act of self-interest!

Beyond the interdependence in the ownership of US Treasuries the below charts highlight an alignment in the US Trade deficit, US Surplus trade in services and the impacts from Investment flows from china in the US.

Conclusion

Trends in China GDP growth and its economic leadership, as implemented through policy and technology, must be at the core of both American and Chinese people. Can it be that an expanding global pie is good for everyone and will lift all boats? We look forward to a healthy debate on Thursday. Note that ETF Think Tank calls are never recorded, so insights are shared only with those on the calls.

Disclosure

The information provided here is for financial professionals only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

All investments involve risk, including possible loss of principal.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).