2019: Everything is Up!!!

For the advisors and investors in the ETF Think Tank, 2019 was generally a prosperous year. We experienced equity markets returning 20% to 30%, commodities and crypto currencies having upside volatility, and even fixed income rallying across the board.

2020: Our First Webinar

In our final ETF Think Tank research note of 2019, we chose to focus on fixed income, with a concept we will be covering on a webinar in mid-January: Are Bond Benchmarks Bad?

Bonds in 2019

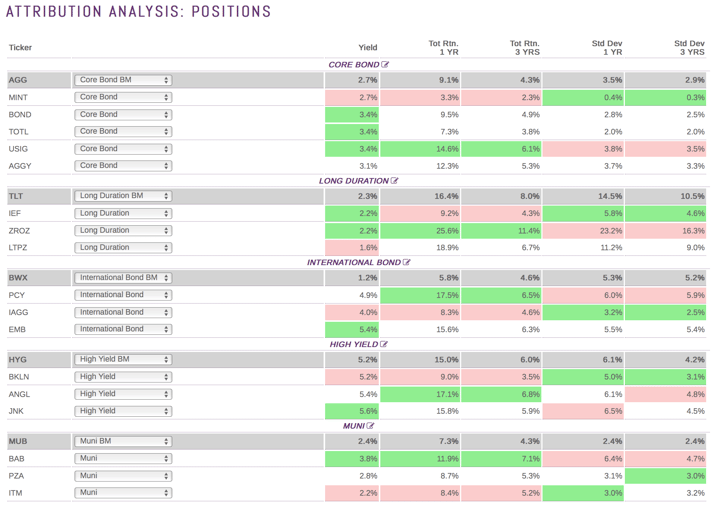

To begin the process of answering our own question, we used the ETF Think Tank Attribution tool to evaluate 5 fixed income categories:

- Core Bond

- Long Duration

- International Bond

- High Yield

- Muni

Data as of December 29, 2019.

In 2019, most fixed income indexes produced positive returns. Higher duration bonds produced substantial upside volatility. Also, lower quality and international fixed income produced superior risk-adjusted returns.

What about 2020?

In the coming weeks, we will share our thoughts on fixed income in 2020.

- Will we see a repeat of 2019?

- Are rates irrelevant?

- Can investors time the bond market?

- Are Bond Benchmarks Bad?

- Is there a better way to invest in fixed income?

Preview: Are Bond Benchmarks Bad?

We have been questioning the merits of traditional bond indexes for many years. Back in 2016, we wrote a piece for ETF.com describing our initial thoughts. The main concern identified in our research, in summary, was that although ETFs have democratized access to fixed income, the traditional indexes negate the two most important covenants of a bond:

- Maturity

- Consistent Coupon/Yield

The resulting behavior of these indexes can be more like equities, cancelling the intended purpose of the fixed income investment.

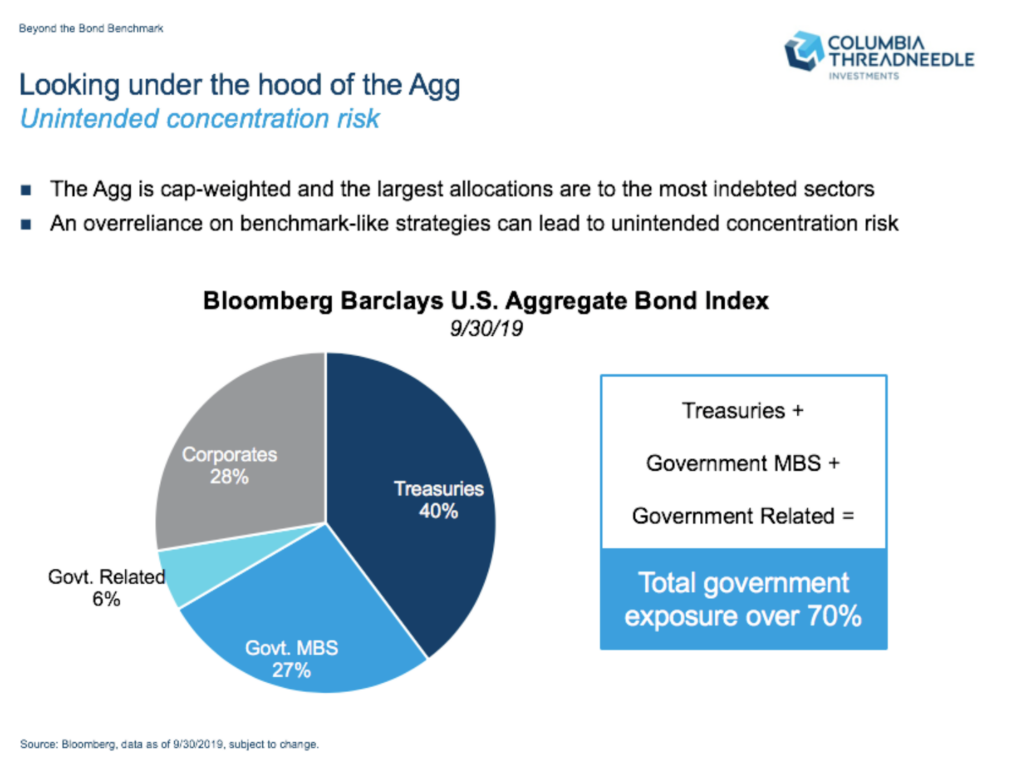

Debt Weighting is Illogical

Recently, we are finding another issue concerning with traditional bond benchmarks: Debt weighting is illogical. This is a simple and obvious statement, that it just doesn’t make sense to overweight the most in-debted sectors or companies. Our friends at Columbia Threadneedle have put together the slide below to illustrate the folly of this process.

Register and Win

We encourage you to look out for our official invite to join our Webinar on January 16, 2020 at 2pm EST: Thoughtful Alternatives to Bad Bond Benchmarks.

And for those of you who were hoping for the Apple Airpods Pro this holiday season, your registration counts as an entry to win!

Please contact us for direct access to the ETF Think Tank tool.

Wishing you a happy and prosperous New Year!

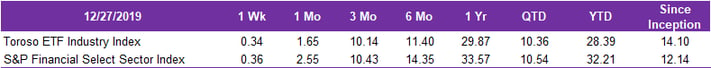

| TETF.Index Performance |

| Returns as of December 27, 2019. Inception Date: April 4, 2017.Index performance is for informational purposes only and does not represent any ETF. Indexes are unmanaged and one cannot invest directly in an index. Past performance is NOT indicative of future results, which can vary. |

| TETF.Index Performance vs. Leading Financial Indexes |

| Click here for information on the Index following the ETF industry |