The world of investment management is evolving rapidly and driven by advanced technologies and innovation. Last week, commission-free trading of ETFs and equities expanded monumentally with announcements from Charles Schwab, TD Ameritrade, and E*Trade.

Welcome to a world with free ETFs and Index Funds, free Robo-Advisors and free trading.

Is Free a Bad Thing?

These announcements have left many advisors confused by the implications of these changes and, in some cases, decimated the stock prices of discount brokerage firms.

At the ETF Think Tank, we believe the commoditization of investment transactions to essentially zero fees, is great for investors and independent advisors. In our opinion, there has never been a better time to be an investor in this country.

However, what are the implications for the survival of the infrastructure needed to support fiduciary financial advisory and asset management practices?

The chart below from Bloomberg illustrates the historical breakdown of revenues of Schwab, TD and E*Trade:

Source: https://twitter.com/mbarna6/status/1179484031160852481?s=20

Is it possible that by making trading free, clients might trade more but less rationally? Will uninformed investors trade more frequently at inefficient prices? In other words, will volume increase by this move that could unintentionally promote bad investor behavior? Or would this move allow discount brokerage firms to simply recapture the revenue via other revenue sources like order flow?

Only time will tell, but what is explicitly clear is that fiduciary advisors that can guide investors toward well-run responsible portfolios and planning, are more necessary than ever before in navigating these disruptions and opportunities.

Actually, that is where we see the biggest value of our ETF Think Tank: to assist financial advisors with great technology and tools, innovative investment ideas, and research to make their value proposition better and stronger.

Trust Still Commands a Premium

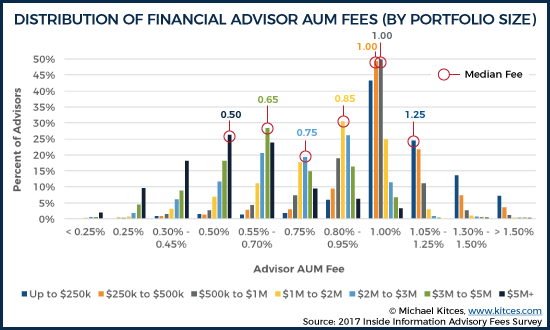

Despite the commoditization of financial transactions, the fees charged by advisors for personalized advice has remained relatively consistent. The average fee for working with a financial advisor seems to remain around 1% of AUM.

It is our belief, that the trust placed in these advisors is difficult to digitize and replicate through technology and therefor can still command a premium. Michael Kitces wrote a spectacular article in 2017 dissecting advisor fees that still rings true today.

Although part of the financial advisor’s value proposition has been commoditized, the personal trust with clients is irreplaceable. We believe advisors must embrace innovation, customization and holistic approaches in order to attract new clients and take care of the existing ones, but trust and a solid relationship will always be the pillar for attracting and retaining new investors.

Building that trust will require a better understanding of three things: 1) all the products and services available; 2) the prices of those products and services; 3) and the reason and rationale behind those prices. Ultimately, a free product or service might be an expensive one. Conversely, a pricey spend on excellent advice could ultimately be a bargain.