Happy graduations to so many ambitious students. Your journey is just beginning! In this period of IPOs and Unicorns I found this video from May 2002 fun to reflect on; especially since Netflix has become such a core part of our family life and in May my kids return to me. https://www.cnbc.com/2019/02/01/netflixs-ipo-in-2002-watch-cnbcs-coverage.html?__source=twitter%7Cmain

Really – there seems to be something in it for everyone:

- Reed Hastings… An IPO is like a “High School Graduation.. Big at the time, but with hindsight only the beginning of something else.” (Sounds like Blockchain? The period of 1999-2002 saw a boom and bust for so many internet and technology companies, but also in hindsight it became clear that dynamic companies like Netflix that adapted through technology would not only survive they thrived.) His comments about Amazon $AMZN and Blockbuster (Acquired)

- FANG and FAANG lovers can look for 3 X & 2X leveraged Exchanged Traded Notes (ETN) with about 10% in Netflix $NFLX. Note the 3 x bet on $FNGU vs the 2x $FNG0 will not neatly correspond for a whole host of reasons and I do NOT recommend these types of securities, but I do appreciate the innovation of the structure.

- $AMZN which is the largest weighting in the First Trust Dow Jones Index $FDN may have captured most of the mind share of investors, but $NFLX stock performance has been the driver. (Up 3,295% since May 17, 2012). To capture a 5% weighting in Netflix investor can also look at Entrepreneur ETF (ENTR) with a 5% weighting,First Trust ISE Cloud Computing Index $SKYY and the John Hancock Multifactor Media and Communications ETF $JHCS.

- The Invesco Nasdaq Internet ETF $PNQI has the largest weighting at about 7.7%; excluding the leveraged ETNs.

- The below charts are designed to highlight how $NFLX has added to the perforamnce of $FDN and even outperformed $AMZN.

Amazing enough – the performance since its graduation from high School back in 2002 from its $15 IPO price is 32,390%.

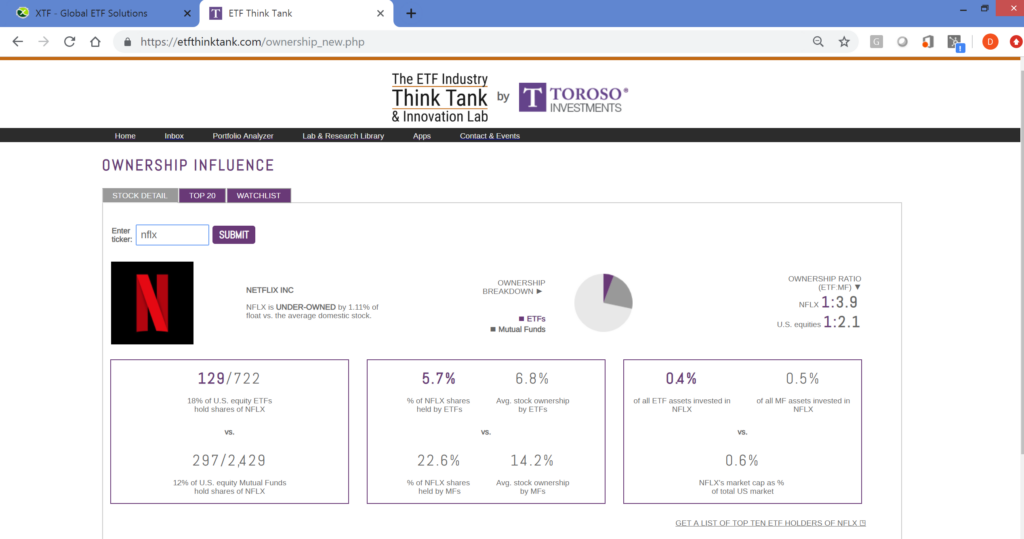

- Surprise Nerd Tidbit – Netflix is underowned by ETFs at about 5.7%, but mutual funds own over 22% of the shares. There are about 200 ETFs that own Netflix.

- Skeptics about #Blockchain should view the video and think through the parallels between what happened to the technology industry from 2000 to 2002 and to today and what the magnitude of change and disruption will come from Blockchain. The question is who will find the winners and avoid the losers?

Again, happy graduation to all those young minds! Enjoy your journey! Work hard to innovate and grab the opportunities before you knowing that disruption comes with innovation and risk taking. The video highlights that before going public with a market cap of $82.5 million Netflix had accumulated losses of $147.8 million.