We had 2 Due Diligence Calls with Distillate Capital ($DSTL) yesterday http://distillatecapital.com/

The key to this strategy, as is the case for most of the strategies in the Tank is that they differentiate themselves both with their investment process, but also in terms of past alpha (backtests are included in our due diligence). It is true that no one has ever seen a bad back test, but I would argue that these past 10 years are equally less of an indication of the future market returns so I work with what data I have and drill deep in my analysis.

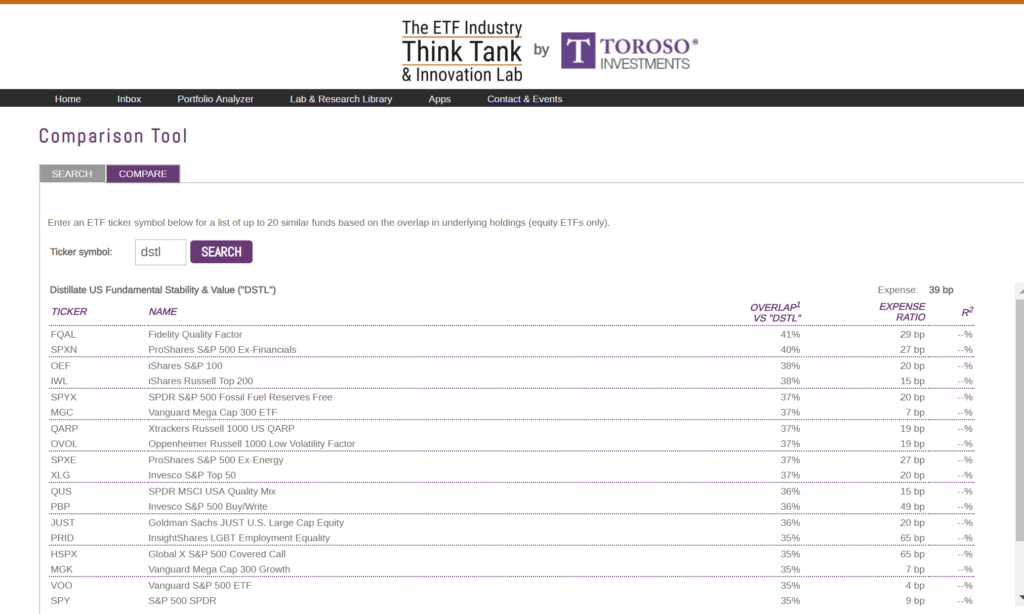

In the below analysis, while the process defines itself as a value strategy what is equally important to me is that the overlap of this fund is low versus other ETFs strategies. Owning something different may change correlation analysis, but logic and reason should conclude that a differentiated outcome can add value to a client’s experience.

In the Tank, our due diligence calls focus on Alpha, Risk and security selection. Thank you Ron and Jim for your time and interest in the Tank. Your questions and insights made me smarter and add value to my personal research. Your dedication to your clients is admirable and it is no wonder that both your firms are having success both in terms of growing your assets and performance.

Best to All on Today’s market Battle,

Dan, “The ETF Professor”