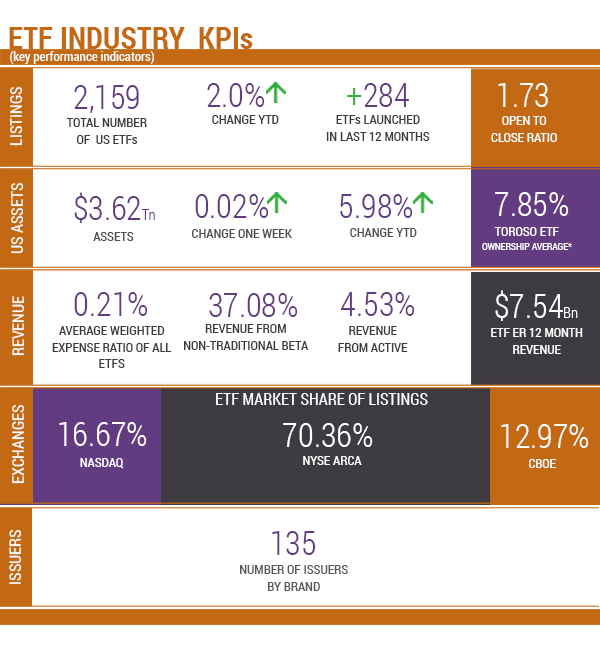

Source of KPIs: Toroso Investments Security Master, as of August 20, 2018

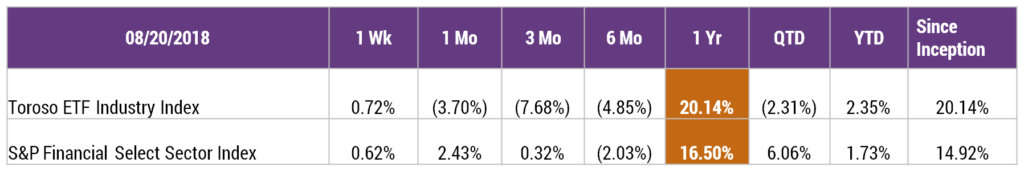

INDEX PERFORMANCE DATA

Returns as of August 20, 2018.

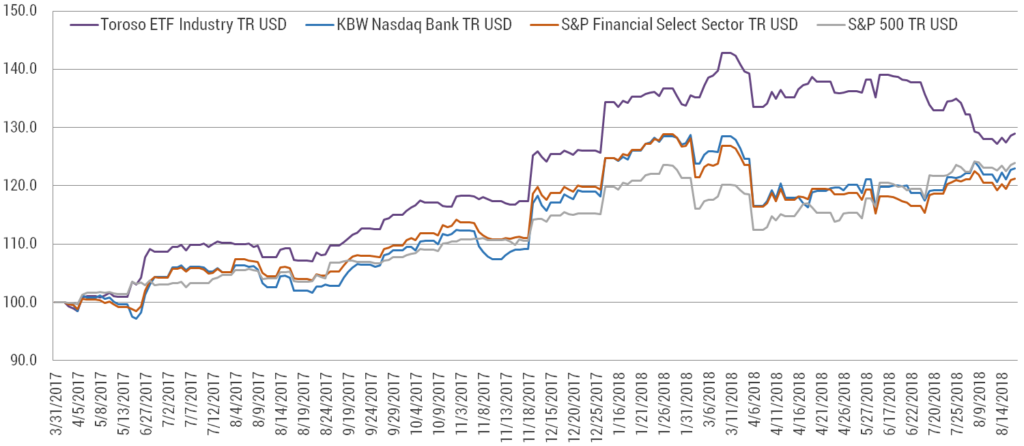

Inception Date: April 4, 2017. Index performance is for informational purposes only and does not represent the ETF.

Indexes are unmanaged and one cannot invest directly in an index.

Past performance is NOT indicative of future results, which can vary.

Thematic Growth

Over the past few years, thematic ETF investing has grown significantly. Of the 151 ETFs launched in 2018, 22 were thematic. Thematic ETFs now represent close to $62 billion in assets or about 2% of all US ETF assets. They also tend to have relatively high fees with an average weighted expense ratio (AWER) of 0.62%, which is more than three times the 0.20% AWER for the overall industry. This movement toward thematic is truly what theTETF.index committee refers to as an innovation growth factor for both assets and revenue within the ETF ecosystem.

What is a Theme?

Within the ETF Think Tank security master, we define thematic ETFs as:

An ETF that seeks to provide exposure to a trend or developing business model through the compilation of securities from multiple sectors. Themes are often global and encompass multiple businesses within the supply chain supporting the global growth trend.

Thematic investing is usually global, but can target specific geographies. Also, most thematic ETFs are non-traditional indexes (we killed Smart beta last week), but there are a few are constructed utilizing the traditional index processes.

How are Thematic ETFs Used?

Within the ETF Think Tank we have identified three primary uses for thematic ETFs.

- Exposure to a Global Growth Trend

These ETFs look to provide investors access to the performance of a global growth trend that doesn’t meet the traditional definitions of a sector or industry. These themes are often transformational, but encompass multiple sectors like the ROBO Global® Robotics and Automation Index ETF (ROBO) or ETFMG Prime Cyber Security ETF (HACK) ETF.

- Diversification

Most thematic ETFs have extremely high active share when compare to traditional beta indexes. Many securities that have significant weights in thematic ETFs are completely left out of traditional beta. We provide investors access to our Smart Cost Calculator in the ETF Think Tank to help them quantify the cost of that active share.

- Trading Access

Many thematic ETFs succeed because they bring liquidity and options to themes that are often difficult to trade. These trading challenges usually come from top heavy themes like Invesco Solar ETF (TAN), Invesco Water Resources ETF (PHO), or Global X Social Media ETF (SOCL).

Also, these themes may be dominated by international or emerging market companies that require trading in the local currency.

The Ultimate Meta Theme

We have often described the self-referenced or meta nature of TETF.index. This index allows investors to track the growth of publicly traded companies within the ecosystem of the ETF industry. As a theme, the meta nature becomes even more prevalent, since this index tracks the movement toward ETFs, which is currently experiencing growth from a move toward thematic investing.

ETF LAUNCHES

| Loncar China BioPharma ETF | CHNA |

TETF INDEX PERFORMANCE VS LEADING FINANCIAL INDEXES

As of August 20, 2018

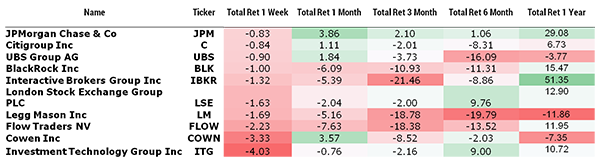

TOP 10 HOLDINGS PERFORMANCE

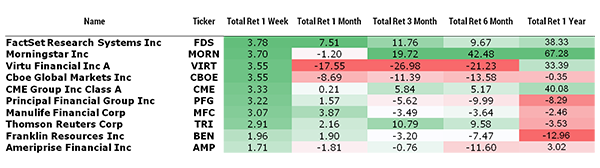

BOTTOM 10 HOLDINGS PERFORMANCE