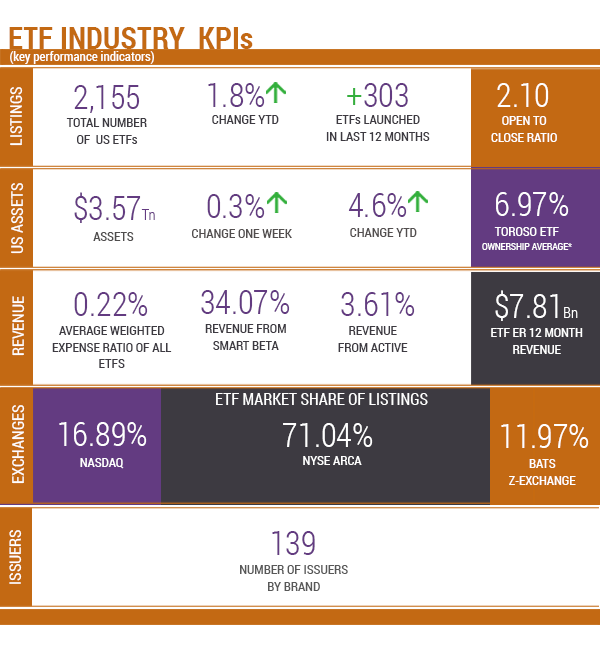

Source of KPIs: Toroso Investments Security Master, as of March 16, 2018

INDEX PERFORMANCE DATA

| 03/16/2018 | 1 Wk | 1 Mo | 3 Mo | 6 Mo | 1 Yr | QTD | YTD | Since Inception |

|---|---|---|---|---|---|---|---|---|

| Toroso ETF Industry Index | (2.09%) | 3.17% | 11.44% | 27.35% | 10.97% | 10.97% | 39.78% | |

| S&P Financial Select Sector Index | (2.38%) | 0.09% | 4.25% | 17.68% | 18.90% | 3.93% | 3.93% | 23.83% |

GOLD FOR ETF LEPRECHAUNS

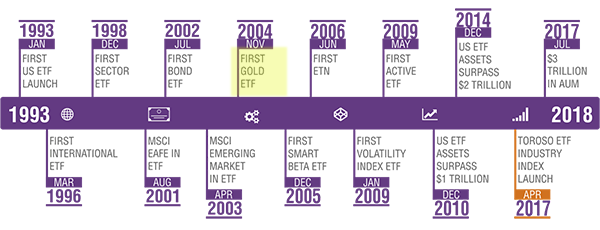

With St. Patrick’s Day over the weekend, we’ve been thinking about gold. More specifically, gold ETFs, of course. While today there are 31 ETPs that focus on gold, fifteen years ago it was much harder to purchase this asset. In November 2004, the SPDR Gold Shares ETF (GLD | A-100) was launched and investors could easily allocate directly to gold for the first time. Today, GLD is the 20 th largest ETF in AUM with over $35 Billion in assets and the iShares Gold Trust (IAU /B-99), the second highest gold ETF, is way behind at $11 Billion.

Innovation in 2004

One of the clearest examples of an innovation growth factor for the ETF Industry has been the development of the Commodity ETF category due to GLD’s creation.

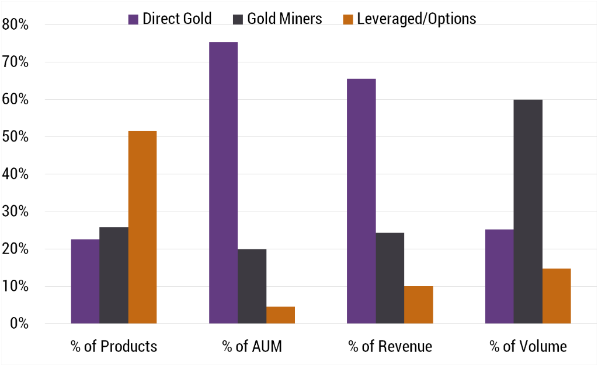

Many things have changed in the last 15 years. There are now 31 ETFs that focus on gold with revenue projected from them to be over $260 million. To better understand the growth, we divided these ETPs into three categories: Direct Gold Price Exposure, Gold Miner Equities, and Leveraged/Inverse/Options.

GOLD FOCUSED ETPs

Direct Gold Price Exposure is offered in 7 products. Most attempt physical replication utilizing the grantor trust structure. Although most gold products are taxed as collectibles, there are two exceptions: an ETN, ticker UBG, from UBS which is taxed like a bond and DGL from Invesco which uses Gold futures. The 7 ETPs represent 75% of the ETF assets dedicated to gold and 66% of the revenue. They have an average weighted expense ratio of 0.37%. In addition, there’s an interesting newcomer from Granite Shares, BAR, with the lowest expense ratio of the group at 0.20%.

There are 8 ETFs focused on Gold Miner Equities. Due to an average weighted expense ratio of 0.51%, these ETFs represent only 24% of the revenue as it is only 20% of the assets. Although the 7 ETFs include multiple different subsets like junior miners and explorers, almost 65% of the assets are concentrated in GDX from Van Eck. The most surprising statistic for this group is the average 3-month trading volume; the miners have traded more than double the volume of Direct Gold ETPs. The interesting newcomer in this bunch is GOAU from US Global Investors, which focuses on the gold royalty miners.

The final category, Leveraged/Inverse/Options, is full of surprises. They represent the most products, but the least amount in terms of assets, revenue, and, shockingly, the lowest volume!! At an average weighted expense ratio of 0.92%, they are by far the most expensive gold ETPs. This group includes leveraged and inverse version of gold and gold miners. We also included in this group three very interesting gold derivative plays. First, we have written in the past about gold with income from GLDI, an ETN from Credit Suisse that uses a gold buy-write strategy to distribute option premium. Second, GHS from Rex ETFs, which provides 100% exposure to Gold and 100% exposure to the S&P 500 per share through a unique application of leverage. And third, GLDW from State Street, which uses futures to remove the exposure to the US dollar from gold.

As we look to the future, Bitcoin and other cryptocurrencies are starting to come into the conversation as primary global currencies. While gold has been a chief store of value for a long time, Bitcoin is not even a decade old. However, that shows how fast business and currencies move today. Many people don’t know or remember that several of the initial Bitcoin filings used the same structure as GLD. We expect innovations like these to continue to drive the growth of the ETF Industry.

ETF LAUNCHES:

Barclays ETN+ FI Enhanced Europe 50 C FFEU

Barclays ETN+ FI Enhanced Glb Hi Yld B FIYY

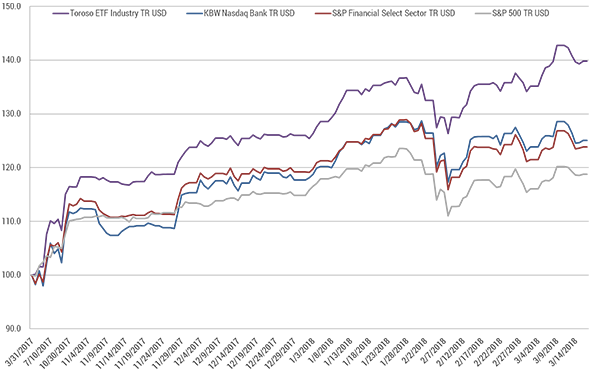

TETF INDEX PERFORMANCE Vs. LEADING FINANCIAL INDEXES

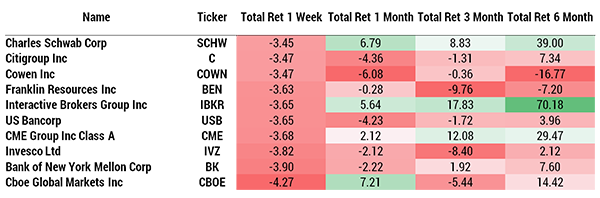

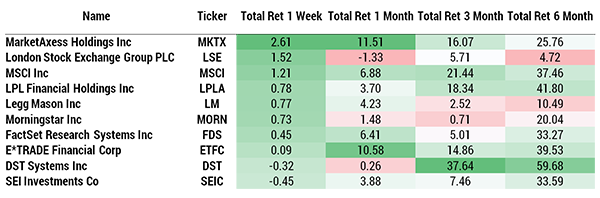

TOP 10 HOLDINGS PERFORMANCE

BOTTOM 10 HOLDINGS PERFORMANCE