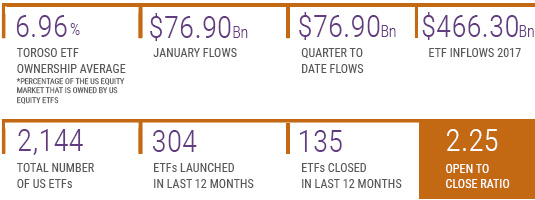

(Key Performance Indicators)

INDEX PERFORMANCE DATA

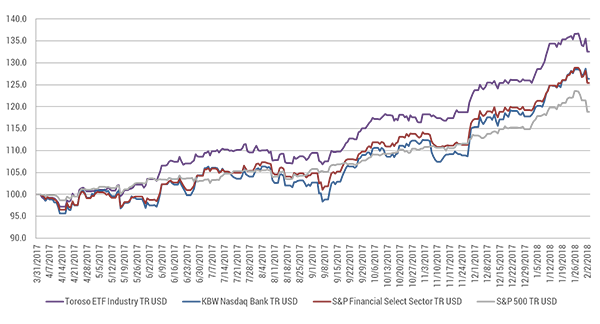

| 2/02/2018 | 1 Wk | 1 Mo | 3 Mo | 6 Mo | 1 Yr | QTD | YTD | Since Inception |

|---|---|---|---|---|---|---|---|---|

| Toroso ETF Industry Index | (3.04%) | 5.64% | 12.07% | 20.37% | 5.19% | 5.19% | 32.50% | |

| S&P Financial Select Sector Index | (2.68%) | 5.30% | 9.80% | 17.18% | 28.65% | 5.24% | 5.24% | 25.42% |

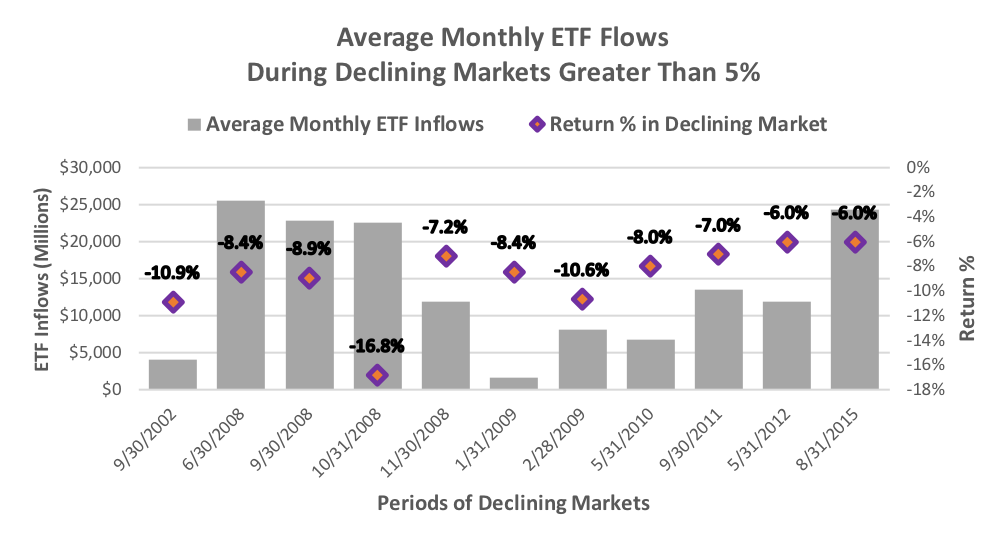

ETF RESPONSE TO A BEAR MARKET POSSIBILITY

Volatility has returned to the markets after historical levels of dormancy. What does this mean for the ETF ecosystem? After almost 77 billion in inflows in January, what should we expect to see with increased volatility?

Bloomberg noted last week that ETF flows were strong even though we experienced a sharp market sell-off. We decided to explore how ETF flows have historically responded to market declines.

HOW HAS VOLATILITY AND MARKET DRAWDOWNS AFFECTED ETF FLOWS HISTORICALLY?

We reviewed ETF monthly flows following a market pull back. Specifically, when S&P 500 returns were worse than -6%, we calculated the average of the following 3 months ETF flows. As you can see, negative returns have actually been beneficial for ETF flows!

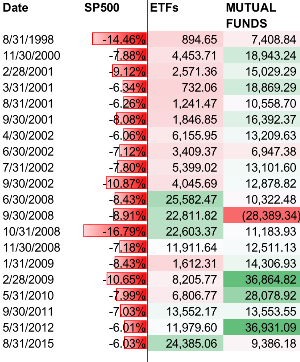

The table below is the 20 worst months for the S&P 500 returns over the last 20 years, and the average respective ETF and Mutual Fund flows in the following 3 months.

ETF FLOWS ARE STRONG FOLLOWING MARKET PULLBACKS

While Mutual Fund flows overall are still higher than ETFs over time, the shift is changing, even in sporadic market pullbacks. It’s clear to see when bigger pullbacks occur, and tax basis is less of an issue for investors, the shift towards ETFs as the preferred vehicle for market investments has grown.

These findings also end the myth that ETF flows turn negative in a bear market. The data illustrates that during the worst months of the market history, ETF flows respond positively.

ETF LAUNCHES

| KraneShares MSCI All China Hlth Care ETF | KURE |

| WisdomTree CBOE Rssll 2000 PtWrt Strt ETF | RPUT |

| Motley Fool 100 ETF | TMFC |

| Innovation Shares NextGen Protocol ETF | KOIN |

| JPMorgan USD Emerging Mkts Svr Bd ETF | JPMB |

| JPMorgan Long/Short | JPLS |

ETF LAUNCH OF THE WEEK: JP MORGAN LONG/SHORT JPLS

This ETF came out more than a week ago but we thought we would mention anyways, since considering the downturns last week, we need more ETFs that help protect on the downside.

TETF INDEX PERFORMANCE Vs. LEADING FINANCIAL INDEXES

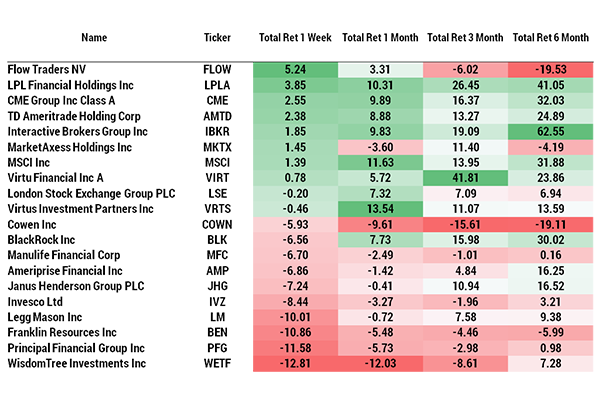

TETF INDEX UNDERLYING TOP/BOTTOM 10 HOLDINGS PERFORMANCE