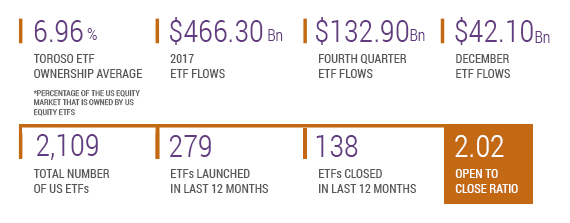

(Key Performance Indicators)

INDEX PERFORMANCE DATA

| 1/5/2018 | 1 Wk | 1 Mo | 3 Mo | 6 Mo | 1 Yr | QTD | YTD | Since Inception |

|---|---|---|---|---|---|---|---|---|

| Toroso ETF Industry Index | 4.53% | 6.75% | 13.59% | 22.19% | 6.70% | 6.70% | 34.40% | |

| S&P Financial Select Sector Index | 2.88% | 4.10% | 12.46% | 18.76% | 27.20% | 4.71% | 4.71% | 24.79% |

Returns as of January 12, 2018.

Inception Date: April 4, 2017. Index performance is for informational purposes only and does not represent the ETF. Indexes are unmanaged and one cannot invest directly in an index.

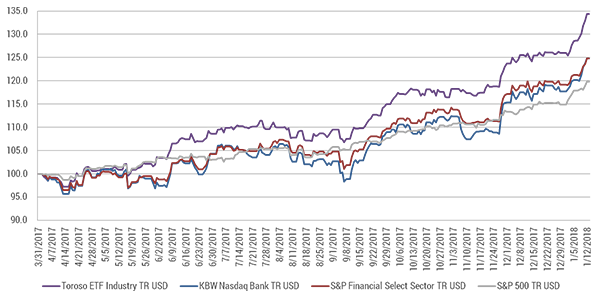

TETF INDEX PERFORMANCE Vs. LEADING FINANCIAL INDEXES

THE FUTURE OF ETFs:2018

In this week’s ETF industry update, we examine what the ETF space will look like in 2018.

Last week Ari Weinberg wrote in the WSJ a collection of ETF growth predictions for 2018.

On January 9th, Barron’s published an abridged version titled, “What to Watch for in ETFs in 2018.”

Below we list the 5 things that they predict and give our take on each one. Number three is especially interesting.

ETF Predictions from the articles:

PREDICTION 1: Fixed-income ETFs

“Rising short rates and a flattening yield curve will shine a spotlight on fixed-income fund performance and drive more investors to consider ETFs, both active and passive”, according to Todd Rosenbluth, senior director of ETF and mutual-fund research at CFRA.

We covered this in a previous blast. There are $4.3 trillion dollars in fixed income assets through ETFs and Mutual funds, with only 13% coming from ETFs. We view that fixed-income ETFs have been under-utilized and that 2018 will exhibit growth in this area.

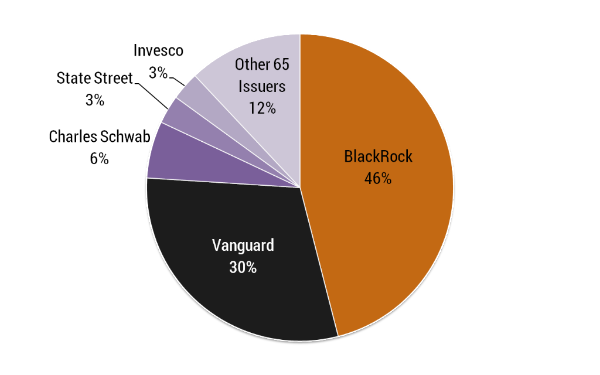

PREDICTION 2: Proliferation

”Even with 123 fund sponsors already in the U.S. market, Toroso’s Michael Venuto sees room for more entrants. New issuers and products will fall into three categories”, he says: ”hot ideas, catch-up by existing asset managers and insurers, and RIAs converting separate accounts to ETF-based strategies.”

% OF 2017 ETF INFLOWS BY ISSUER

Source: Toroso Am

We expanded on this in our report about the ETF rising tides and concur (with our CIO Mike Venuto) that the ETF industry is not nearly as saturated as some investors may think.

PREDICTION 3: Innovation

”Empowered by investment trends in the legal-marijuana industry and bitcoin/blockchain ecosystems, ETF issuers have applied to list at least six marijuana-investment products and 16 bitcoin/blockchain-related strategies”, according to Bloomberg ETF analyst Eric Balchunas. ”And two exchanges—NYSE Arca and Cboe Global Markets—have applied to list bitcoin ETFs in the U.S. Expect more of these outside-the-box plays this year.”

Eric’s prediction came true!

We are excited to announce that Amplify has launched the first active blockchain-focused ETFand Toroso is the active sub-advisor. The fund launched today on NYSE, for more information click here.

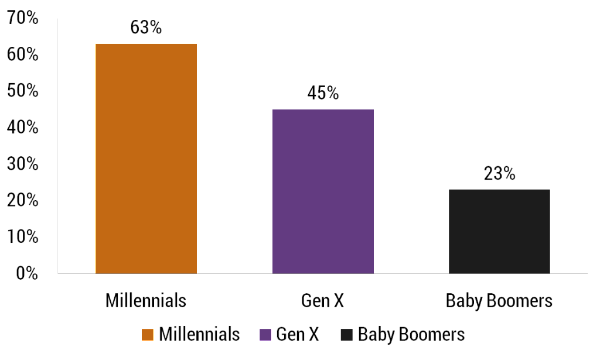

PREDICTION 4: ETFs powering Robos

”JPMorgan Chase revealed plans for a digital-wealth offering in December, following Morgan Stanley and Merrill Lynch.”

We believe this to be a part of the millennial trend. In a previous weekly update, we discussed the wave of Millennials choosing ETFs as their investment vehicle of choicemore than any other generation because of trust. The future robo advisor is more of a hybrid model and robos / ETFs should grow through offering a technological benefit to advisors in 2018.

Source: Schwab’s 2017 ETF Investor Study

PREDICTION 5: Active management redefined

”Vanguard is gearing up to blow a hole in the active/passive distinction by introducing low-cost, actively managed ETFs in the first quarter—index funds with that will hone in on factors like momentum, value and volatility.”

This belief is consistent with our concept of innovation growth factors. The industry will continue to mature and be more than just a low-cost option. The low-cost actively managed funds will continue to put pressure on hedge fund’s value proposition over ETFs. We covered this in-depth in our update on looking beyond free beta.

ETF LAUNCHES

01/11/18 InsightShares LGBT Employment Equality ETF PRID

01/11/18 Xtrackers High Beta High Yield Bond ETF HYUP

01/11/18 Xtrackers Low Beta High Yield Bond ETF HYDW

01/10/18 Xtrackers Short Duration High Yield Bond ETF SHYL

ETF LAUNCH OF THE WEEK

We are very proud of our selection for ETF of the week: congratulations to InsightShares and their PRID ETF.

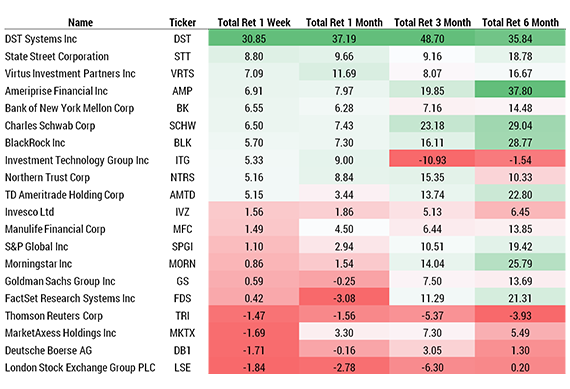

TETF INDEX UNDERLYING TOP/BOTTOM 10 HOLDINGS PERFORMANCE

As of January 12, 2018. Source: Morningstar Direct.