Using ETFs to own small cap stocks can be a tricky proposition and requires investigative analysis to uncover what the investor truly owns. We find that small cap stocks, as an asset class, are generally unsuited for indexing since most indexation methodologies over-weight the largest companies and thereby often fail to capture the expected small cap exposure. So it is important to know what index the ETF is based on and how it impacts the holdings. As we will see, the index method being used in the ETF can have a material effect on the holdings and create unintended results.

During any market cycle we believe it is important to identify the goal of having small cap exposure. By stating your goal, then you can search for ETFs that best express your point of view. Some investors are purchasing small cap stocks because they represent the best opportunities for company growth, or because the valuation metrics offer room for expansion, or these companies are more likely to be acquisition targets. Different ETFs support each goal differently. In the research that follows we provide some of our insights into this popular asset class.

The Small Cap ETF Universe

Statistics show that most investors look for core (blend), growth, or value and then choose the largest or cheapest fund with small cap, small cap growth, or small cap value in the name. So let’s build a composite of these ETFs and look under the hood and see what the fundamentals look like. The universe of US focused passive small cap ETFs contains 53 ETFs and represents about $77 billion in assets. The top 25 funds have 98.2% of these assets and makes for a strong list to select ETFs for this asset class. Toroso reviewed this universe by taking these 25 ETFs and built an asset-weighted composite we could compare to the broad market. Table #1 in the Appendix lists the 25 ETFs used in our select list.

Index and Cap Weighting

From our select list, we chose the top nine ETFs to illustrate how index selection impacts a portfolio. The top nine use three different market cap weighted indexes for the small cap universe. The chart below shows the meaningful differences in the definition of the small cap indexes:

As you can see from this table, the cutoff of each index provider is different, therefore the stocks in ETFs that follow these indexes are different. As a result, the fundamentals of the ETFs are different. The ETF Research Center has defined stocks under $2 billion in market cap to be considered small-cap, and stocks with market caps between $2 and $10 billion to be mid-caps. So, based on this definition and today’s market environment, let’s see what percentage of each of the top nine ETFs is considered mid-cap and small-cap.

Observation #1: Your ETF may not be small cap.

Sectors

We drilled into the select list of ETFs identified in Table #1 and compared sector exposures and found two interesting anomalies when compared to the sector exposures of the S&P 500 Index. First, the exposure to real estate in the small cap ETF universe is about 4 times greater than real estate in the S&P 500 Index. An investor may find this allocation appealing if they believe that the valuation metrics are going to expand. But real estate is generally not considered an acquisition target or candidate for growth. (Please read our April 2013 Commentary for more of our insights into real estate investments.)

Another example of a sector anomaly is the energy sector. In today’s market, energy shows a significant underweight in the small cap ETF select list we established. We believe energy to be a desirable sector with opportunity for acquisition by larger firms, especially around companies involved with alternative energy sources.

Observation #2: Certain sectors are over-weighted and under-weighted.

Profit Margins and Price to Earnings Ratios

Profit margins are at very high levels. Standard & Poors’ reports the average for the largest 500 stocks by market cap over the last 75 years is 4.9%. Today, according to the ETF Research Center, the net margins for the stocks in our small cap ETF select list is about 6% and the net margin for the SPDR S&P 500 ETF Trust (SPY) is 10.6%. When margins are high like this, we believe there is a higher likelihood that the margins will compress and revert to normal levels. One of the reasons to own small cap stocks is for their higher likelihood of acquisition, which in our opinion is diminished when margins are too high because the acquiring firm is looking for ways to increase margins. Specifically, firms with high revenues and lower margins in today’s market provide opportunities for the acquirer to realize efficiencies in the merger. In today’s market, Toroso looks for ETFs that do not create over-weight anomalies and increase risk of mean reversion.

Observation #3: Aggregate fundamentals can stray far from historical norms.

ETF Ownership Influence

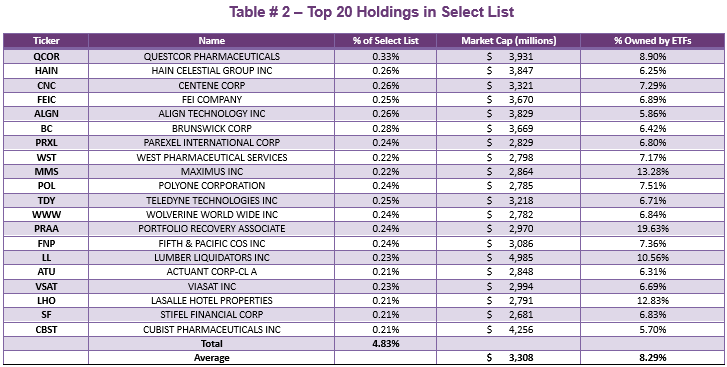

As we said in May’s Commentary on REITs, “Investors must remember that an index is simply a rule set and when assets flow passively to an asset class, dislocations can occur.” To illustrate this point for small caps, Table #2 in the Appendix lists the top 20 stocks in our select list of 25 ETFs. Using Toroso’s proprietary software we have listed the percentage of each stock owned by ETFs. The average ownership of stocks by ETFs is 3.7%, yet in this list you can see that the average ownership by ETFs of these 20 stocks is 8.29%. When this dislocation occurs, greater care is required in selecting ETFs. These 20 stocks represent 4.83% of the $77 billion in small cap ETFs, and an average market cap of $3.3 billion, beyond what is typically considered small cap. In addition, these 20 stocks are overweight healthcare, and the profit margins average 7.09%, according to Morningstar.

In Conclusion – Selecting an ETF

Thus far we have discussed averages and dislocations. All of this is to help identify what is happening in the small cap part of the ETF market. However, at the end of the day, most investors will want some exposure to the small cap asset class and a selection needs to be made. So, here is an ETF that provides asset class exposure and today has very different fundamentals than the aggregate fundamentals of the select list of 25 ETFs.

In our opinion, today’s fundamentals argue for using the RevenueShares Small Cap ETF. The small cap exposure is more in line with expectations, real estate exposure is minimized, price ratios show opportunity for upside, and net margins are closer to norms. These fundamentals change overtime, so Toroso continually monitors the fundamentals of the ETF to ensure the reasons for owning the ETF are maintained.

Disclosure

All investments involve risk, including possible loss of principal.

This material is provided for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).